Spread the cost with

iwoca Pay

Spread the cost of orders up to £30,000 with iwocaPay

Pay Later Work?

Step 1.

Select iwocaPay at the checkout

Don’t worry if you don’t already have an account - you can sign up to iwocaPay before or at point of purchase via the checkout.

Step 2.

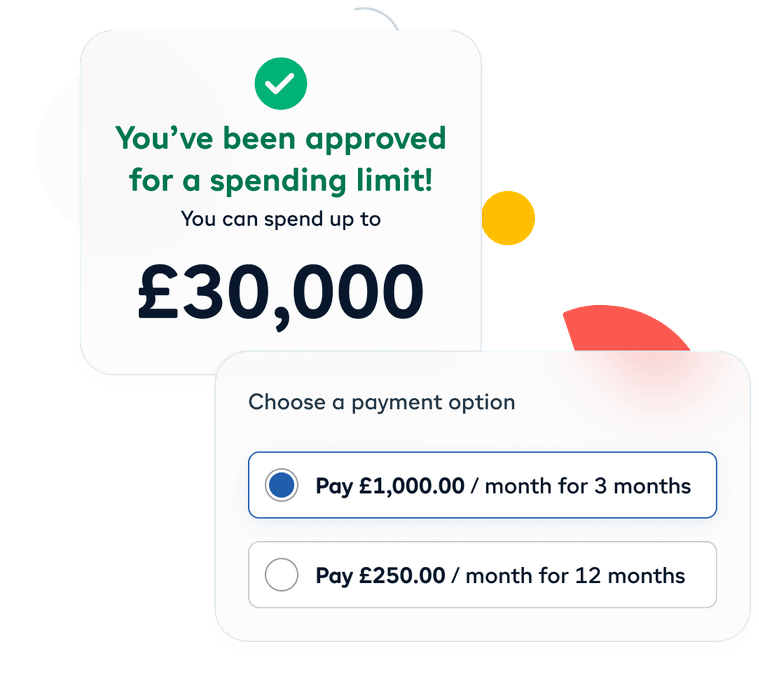

Choose how long you’d like to pay

3 months or 12 months - you’ll automatically see the options that are available to you on this payment. If it’s your first 30 days with iwocaPay you’ll only see a 3 month option.

Step 3.

Log in or sign up to iwocaPay

If you haven’t already got an account iwocaPay will need a few basic details about your business first. It’ll take about 2 minutes, and you won’t need anything to hand.

Step 4.

See your spending limit

Based on those details, iwocaPay will show you how much you can spend with Pay Later. You can use it over as many transactions as you like with any supplier who accepts iwocaPay.

Step 6.

Connect your card for monthly payments

iwocaPay take care of the rest. You never have to worry about missing a payment. There are no hidden fees and you can settle up early or make extra payments.

iwocaPay

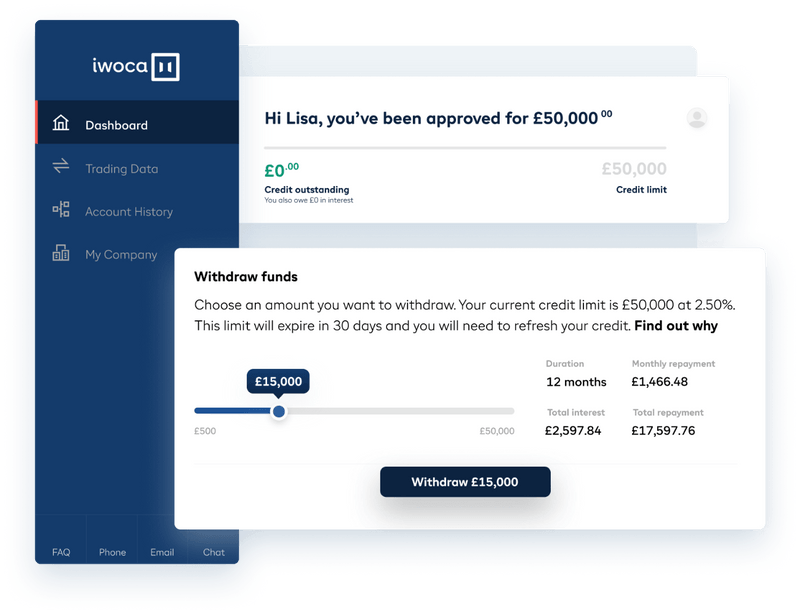

Flexible business loans tailored to your needs

iwoca provides small businesses with flexible funding solutions, offering loans from £1,000 to £35,000. Whether you need capital to invest in growth, manage cash flow, or cover unexpected costs, iwoca’s quick and efficient application process ensures you can access funds without delay. With repayment terms ranging from 1 day to 24 months, their loans are designed to fit your business needs.

What makes iwoca stand out is their flexibility and transparency. With no penalties for early repayment, you have the freedom to settle your loan ahead of schedule, saving on costs. Whether you’re expanding operations or navigating financial challenges, iwoca’s tailored approach ensures your business gets the support it needs to thrive.

iwocaPay

Support for business tax compliance

iwoca’s business tax hub offers resources and expert guidance to help small businesses stay compliant with UK tax regulations. From VAT solutions to reducing overheads, their services aim to strengthen your financial foundation while saving time and effort. Discover how tailored IT solutions in your sector can complement your tax compliance efforts and optimise business operations.

iwocaPay

Quick and hassle-free funding process

iwoca simplifies the loan application process, allowing businesses to borrow between £1,000 and £1,000,000 with decisions made within one working day. Their flexible repayment terms and zero fees for early repayment make them an ideal choice for businesses looking for efficient financial solutions.

With our experience, we can help your IT problelms.

At Qual we work with all types of communication businesses, bringing our wealth of knowledge and extensive experience.

Let’s get started